Effective Tax Reduction Strategies For Small Businessesby. Ayesha Haddad on 07-03-2024

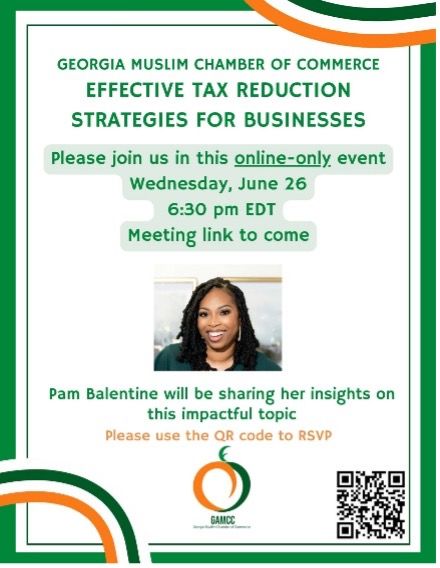

Effective tax reduction strategies for small businesses - presented by Pam Belntine

As Salamu Alaikum,

If you missed the last segment of GAMCC's Learning Series, you missed vital information on Tax Strategies for Business from our Expert Guest Ms. Pam Balentine (PamTheCPA®). Thank you, Br. Tariq Hussain of Atlanta Accounting Associates, for your recommendation. We had a highly informative session where participants were able to get answers to a variety of tax questions.

Some Topics Discussed:

Tax Basics: Things every business should know about taxes

How business structure effects taxation

Key things to do to be ready for tax time

Tax Strategies to minimize tax obligations

Business taxes that are often overlooked

How business taxes can affect personal taxes

When to hire someone to prepare tax returns

More about our Guest Expert:

Pam Balentine holds a Master’s degree in Accounting, and has served as an Adjunct Professor teaching accounting at Kennesaw State University. Pam started Viking CPA Group (https://vikingcpagroup.com/) in March of 2013, serving individuals and small businesses. Viking CPA Group offers a free 15 min consultation. Fill out the form at the link to get answers to questions or discuss your business needs and be sure to mention GAMCC.

We look forward to seeing you at our next installment of GAMCC Learning Series on Wednesday, July 24th, 2024. Details coming soon.

*Please note that our posts are not intended to in any way advise, endorse, or recommend organizations, companies, experts, or individuals. We encourage members to perform their own due diligence before implementing any advice, hiring, or contracting any expert, organization, or company unless explicitly stated in writing.